1. Nongsa Digital Park – Background

Located on the North-Eastern tip of Batam, Nongsa Digital Park (NDP) is developed by Citramas Group to be an ecosystem for the digital economy where digital talents can work, collaborate, and innovate. NDP was inaugurated by the Ministers of Foreign Affairs of Indonesia and Singapore on 20th March 2018. This signified NDP as the ‘Digital Bridge’ between Singapore and Indonesia to grow the digital economy that was identified as a joint growth sector between the two countries during RISING 50 leaders’ retreat in Singapore.

There are currently 6 office buildings that (prior to the COVID outbreak) housed about 1,000 tech talents working for over 100 local and foreign tech companies of various sizes, from startups to multinational companies Apple chose NDP as the location for its 3rd Apple Developer Academy which has been developed in partnership with Cirtramas Group subsidiary, Infinite Studios through the Infinite Learning division of the latter. Infinite Learning provides, under the umbrella of its Vocational Education License, further courses focused on the Digital Economy in collaboration with local and international institutions. For example, its world-class digital animators present in NDP are trained in collaboration with Nanyang Poly and Batam Poly. In July 2020, NDP was officially granted the Special Economic Zone status which is expected to further catalyze the digital and tourism industries in Nongsa. Among the expected benefits:

- Tax incentives, in particular with a focus on Data Centre infrastructure

- Easy access (in/out) for foreigners, longer work permits (Kitas) for the foreign talent required to work in NDP

- Possibility for foreign education institutions to deploy established curriculums to support the growth of Indonesian Talent aspiring at participating in the country’s fastgrowing Digital Economy

A Masterplan, designed by Surbana Jurong, for a large area in Nongsa comprising NDP has been developed and ready to be presented to the public as soon as the current pandemic eases: this will represent a major step towards the establishment of the area as an ideal destination for Digital Economy activities.

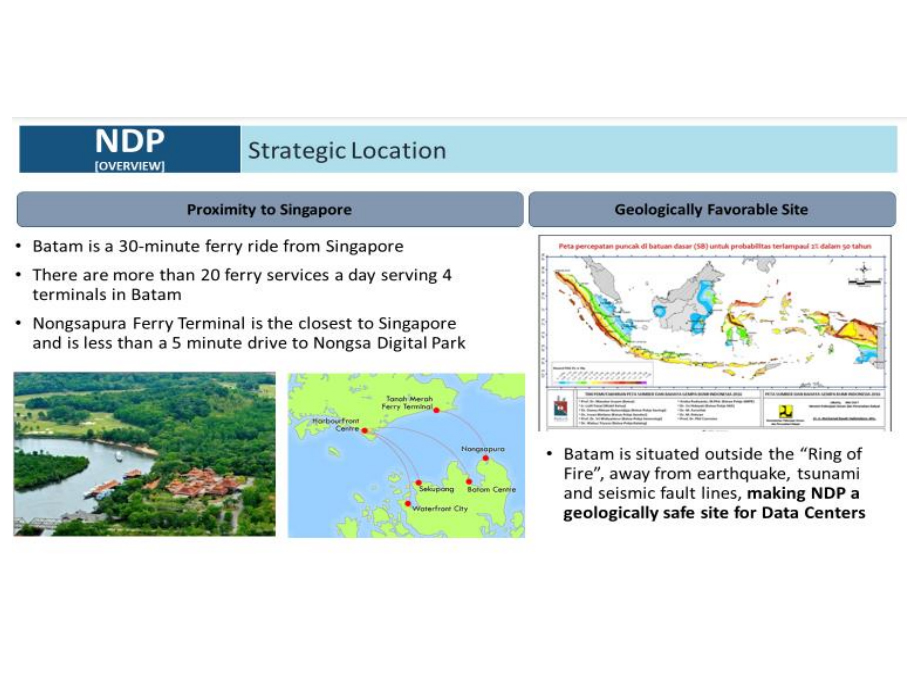

Nongsapura Ferry Terminal has been selected by Indonesian Authorities as a dedicated entry point for foreign travelers thanks to its management and facilities that have allowed NDP to stay Covid-free since the beginning of the pandemic. NDP represents an ideal location for Data Centres as will be further explained in Chapter 4

2. Market Overview

The data center market in Southeast Asia is witnessing growth with the increased interest from cloud providers such as Google, AWS, and Alibaba to open cloud regions. The adoption of cloud-based services will be a key driver for the market in the next few years while increasing internet penetration is likely to aid the use of smart devices in this region.

In 2019, the Singapore Government decided to put a moratorium on building hyper-scale DCs in order to contain carbon consumption. Due to this, large Enterprises and OTTs have been forced to rely on neighboring countries such as Malaysia and Indonesia for DC services.

In line with the rapid growth of the global e-commerce industry today, Indonesia has enormous digital economy potentials in the future. The Indonesian government is focusing on developing the digital economy by increasing the connectivity infrastructures as well as the local market demand.

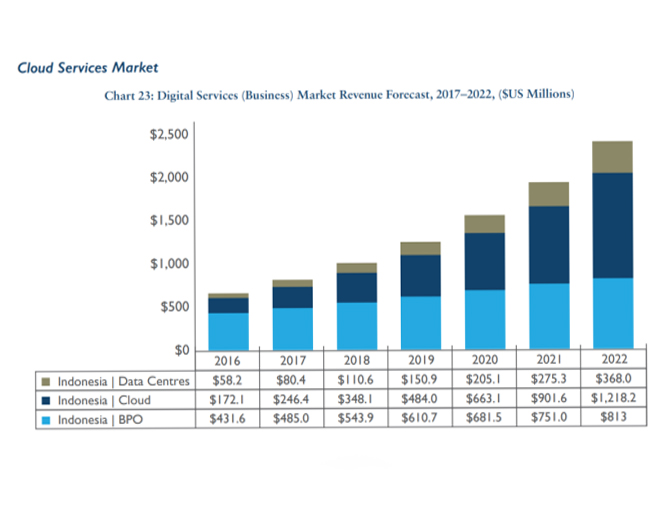

Around 95% of mobile users watch online videos and over 60% of the population now perform banking services via smartphones, increasing the demand for hosting facilities in Indonesia. The Indonesia DC market (by revenues) is expected to grow at a CAGR of around 34% during the period 2020-2022. The rise in the construction of hyper-scale facilities in Indonesia will be driven by the local Unicorns (Go-Jek, Tokopedia, etc.) and the global OTTs (Microsoft, Google, Bytedance, etc.). The implementation of Industry 4.0 Indonesia's digital economy was estimated at over US$30 billion in 2019 and it’s expected to reach more than US$150 billion by 2025.

The Indonesian cloud market is projected to lead the growth of the Southeast Asia cloud ecosystem and it’s expected to reach an overall market size of more than USD1.2 Billion in 2022, while the revenues in the same year generated by the Data Centers will be approximately USD370 Mil.

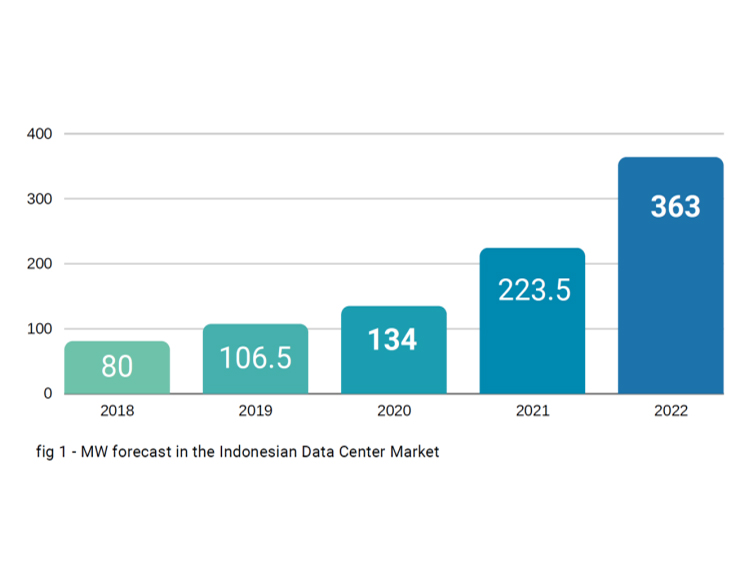

There is also a clear necessity for diversity from the current DC cluster in Jakarta and the Indonesian Government is promoting Batam (an island in front of Singapore) as the digital hub for data centers and international connectivity (Batam is also the main international gateway of Telin network). With a robust pipeline, the Indonesia Data Center market (by capacity) is expected to grow from 134 MW in 2020 (it was 80 MW in 2018) to 363 MW in 2022, with an impressive CAGR of 64% (source: Broad Group).

The main drivers will be Hyperscale Cloud Providers, OTT and Content Providers, corporate, outsourcing to Data Centers, economic growth of Indonesia, Singapore temporary ban on building large DCS.

3. Existing Data Centers in the Region

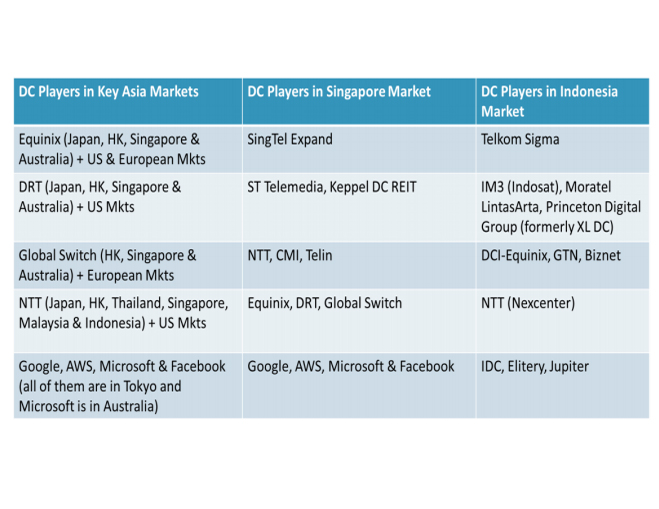

The rapid growth of big data, IoT, artificial intelligence, and virtual reality will have a major impact on the DC market in Southeast Asia countries after 2020. Most colocation providers are involved in the construction of hyper-scale data centers to offer space to cloud service providers. In Southeast Asia, Singapore is the most mature market, followed by Indonesia, Malaysia, Thailand, and Vietnam. Countries such as Thailand, Malaysia, and Indonesia are witnessing an increase in the colocation requirement from cloud service providers.

Besides the US-based hyper-scale cloud companies like AWS, Microsoft, Google Cloud, and IBM Cloud, which have already established a meaningful data center footprint in Singapore, the China-based hyper-scale companies like Alibaba, Tencent, Huawei, ByteDance, JD Cloud, etc. are projected to have a growing share of data center demand in strategic markets like Singapore and Indonesia.

In terms of data center capacity, as of the beginning of 2020, China leads the Asia Pacific with 1,665MW, with Singapore ranking 4th with 483MW (more than HK with 344MW) and Indonesia only 8th with 113MW, although it is growing at a faster pace. In terms of colocation market size, Singapore has recorded USD1,354 Billion revenues in 2019 and is forecasted to reach USD2,5 Billion by 2025, with a CAGR of around 10% (if the local government will lift the ban on new hyper-scale DCS).

Total operational Data Centers in Singapore are currently 65 and the Top 3 Carriers Hotels are run by Equinix, Digital Realty, and Global Switch. Total hyper-scale capacity is approx. 370MW and is forecasted to reach 500MW by 2025.

China Mobile International (CMI), Google, Iron Mountain, Keppel Data Centers + Huawei, and ST Telemedia have been major investors in the data center market in Singapore in 2019. Singapore is a major financial center, and hence a natural colocation hub to serve developing markets in Southeast Asia.

But Singapore is a small country, so more deployments (especially from hyper-scale clouds) will shift into other adjacent countries in Southeast Asia (i.e. Indonesia) and India in the next 5-10 years.

Currently, there are less than 20 DC players in all of Indonesia. They are divided into retailers with less than 5MW facility (IDC, Elitery, Jupiter, etc.), telecom operators (Telkom Sigma, Moratel, Biznet, Indosat, etc.) who offer the carrier hotel model like us and wholesalers or hyper scale with more than 5MW capacity (Princeton, DCI, NTT, GTN, etc.).

The Indonesian data center colocation market is still concentrated in the Greater Jakarta region in West Java. Surabaya in East Java with its Disaster Recovery Centers and Batam for its proximity to Singapore is the next location to grow.

4. Advantages of Batam (with a focus on NDP) for building a DC

- Chosen by Indonesia President Jokowi as its “digital bridge” to the rest of the world

- Private initiative (Citramas Group) committed to building a Digital Economy Tech Park and Data Center Hub

- Earthquake-free zone, the only one in Indonesia which instead lays on the so-called “ring of fire”

- in July 2020, Nongsa Digital Park (NDP) has been selected by Indonesia Government as Special Economic Zone for Digital Economy

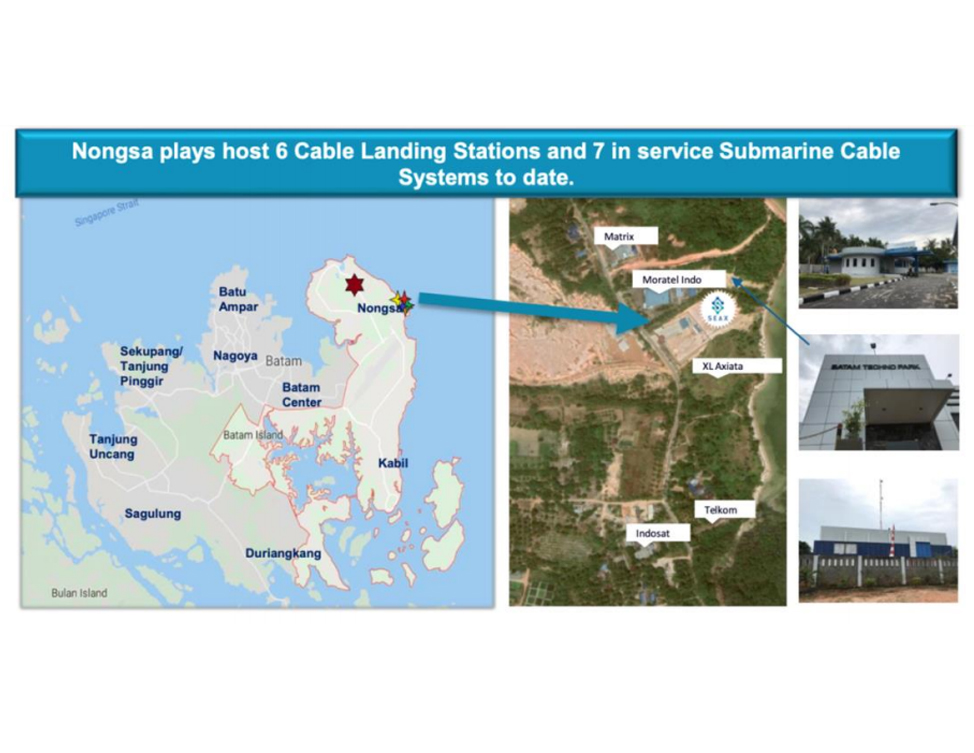

- Batam is the most interconnected point in West Indonesia and Nongsa Area has the highest single count of landing stations and single route cables. No, other geographical region or island in WI has a connectivity status comparable to Batam which boasts:

- 12 submarine cable systems connecting the island to Singapore, Malaysia, and Jakarta and 1 more landing soon from East Malaysia and Brunei:

| No | Cable Name | Owners |

| 1 | Batam-Singapore Cable System (BSCS) | Telin |

| 2 | Indonesia Global Gateway (IGG) System | Telin |

| 3 | Jakarta-Bangka-Bintan-Batam-Singapore (B3JS) | Moratel |

| 4 | Matrix Cable System | Matrix Networks |

| 5 | Moratel International Cable System-1 (MIC-1) | Moratel |

| 6 | PGASCOM | Pgascom |

| 7 | SEAX-1 | SEAX |

| 8 | Thailand-Indonesia-Singapore (TIS) | CAT Telecom, Telin, Singtel |

| 9 | Batam Dumai Melaka (BDM) Cable | Moratel, TM |

| 10 | JASUKA | Telin |

| 11 | Palapa Ring West | Indonesia Government |

| 12 | Jambi Batam Cable System (JIBA) | Moratel, XL Axiata, Indosat Ooredoo |

| 13 | Batam-Kuching Cable System | PPTelecom (Q4 2020) |

Nongsa Area is then the single most connected point within Batam:

- The Indonesian Law is pushing big corporations and local unicorns to have their end-users data distributed in more than one location and Batam (because of

its vicinity to Singapore) is becoming the preferred alternative to Jakarta (rather than Surabaya or Bali) - NDP SEZ status to further guarantee the free flow in and out of the country for third parties data not originated in Indonesia

- manpower, land, and energy are available aplenty: with regards to energy, only Batam within the Riau Islands has a reliable and scalable continuous supply of

the gas which is required to support rising demand for electrical power that will come from Data Centre infrastructure future projects - Furthermore, the Citramas Group is committed to providing in Nongsa a dedicated Electric Power generation solution for DC with an independent gas source and separated grid which will allow better e more secure power redundancy and the possibility to build Tier IV compliant DC infrastructure

5. Connectivity opportunities in Batam (Nongsa)

Once a DC Hub in Nongsa is established with proper data storage infrastructure, there is also an opportunity to provide Indonesia with a 2nd Global IP Transit (EMIX) facility, currently concentrated only in a single point in Jakarta. The current situation is not either desirable nor properly fit with regards to the rapid fast expansion of Indonesia’s Digital Economy.

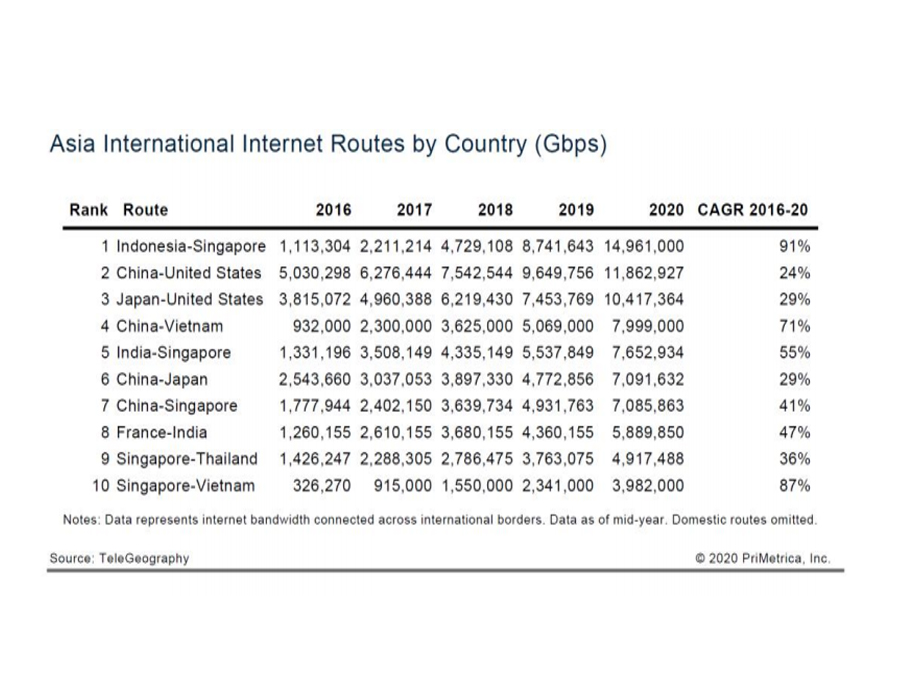

Indonesia cannot afford any longer one single point of failure that, in case of any unfortunate event that might compromise its operativity, will completely shut down any internet communication flow to/from the whole of Indonesia. Historically, the list of largest routes in Asia had been led by those that cross the Pacific (China-US, Japan-US). That has recently changed. Due to its massive growth between 2016 and 2020 (91% CAGR), the Indonesia-Singapore route has already reached 15Tbps of capacity and

topped the list.

Thanks to its location and connectivity with the largest connectivity hub in the Region, Nongsa represents therefore the ideal location for a secondary (complementary) EMIX facility for the Indonesian Digital Economy